how to lower property taxes in florida

In calculating the sales tax multiply the whole dollar. Tax amount varies by county.

Florida Homestead Check Florida Residential Property Tax Experts

According to the Leon County Property Appraiser the full exemption allowed tax payers to save up to 818 last year.

. Your property must qualify for the standard Homestead Exemption. To put 818 into perspective for the typical homeowner. A tax appeal is the last resort for homeowners who want to lower their property taxes.

You must have lived in the. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount.

Property taxes vary from county to county and the average property owner pays about US1700 in property taxes yearly. Property Tax Appeals for Palm Beach County Tel. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the propertys.

Florida is ranked 30th out of 51 including Washington DC when it comes to the highest tax rate in the United States. At least one homeowner must be 65 years of age or older as of January 1st. File a Tax Appeal.

3309 Northlake Blvd Suite 105 Palm Beach Gardens FL 33403. Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is. 097 of home value.

The most significant potential exemption is the homestead exemption which could save you up to 15 on property taxes if you own your home in Florida and it is your primary. Florida Save Our Homes is a Constitutional amendment and related laws that limits how much the assessed value of your primary residence can. Nonetheless there are a few ways that may be helpful.

At an average home price of 156200 this amounts to. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. Florida Save Our Homes. For most investment property real estate taxes are the largest single expense item found on the operating statement which in turn dramatically affects the bottom line net profit.

While you wont be able to contest the tax rate you will be able to.

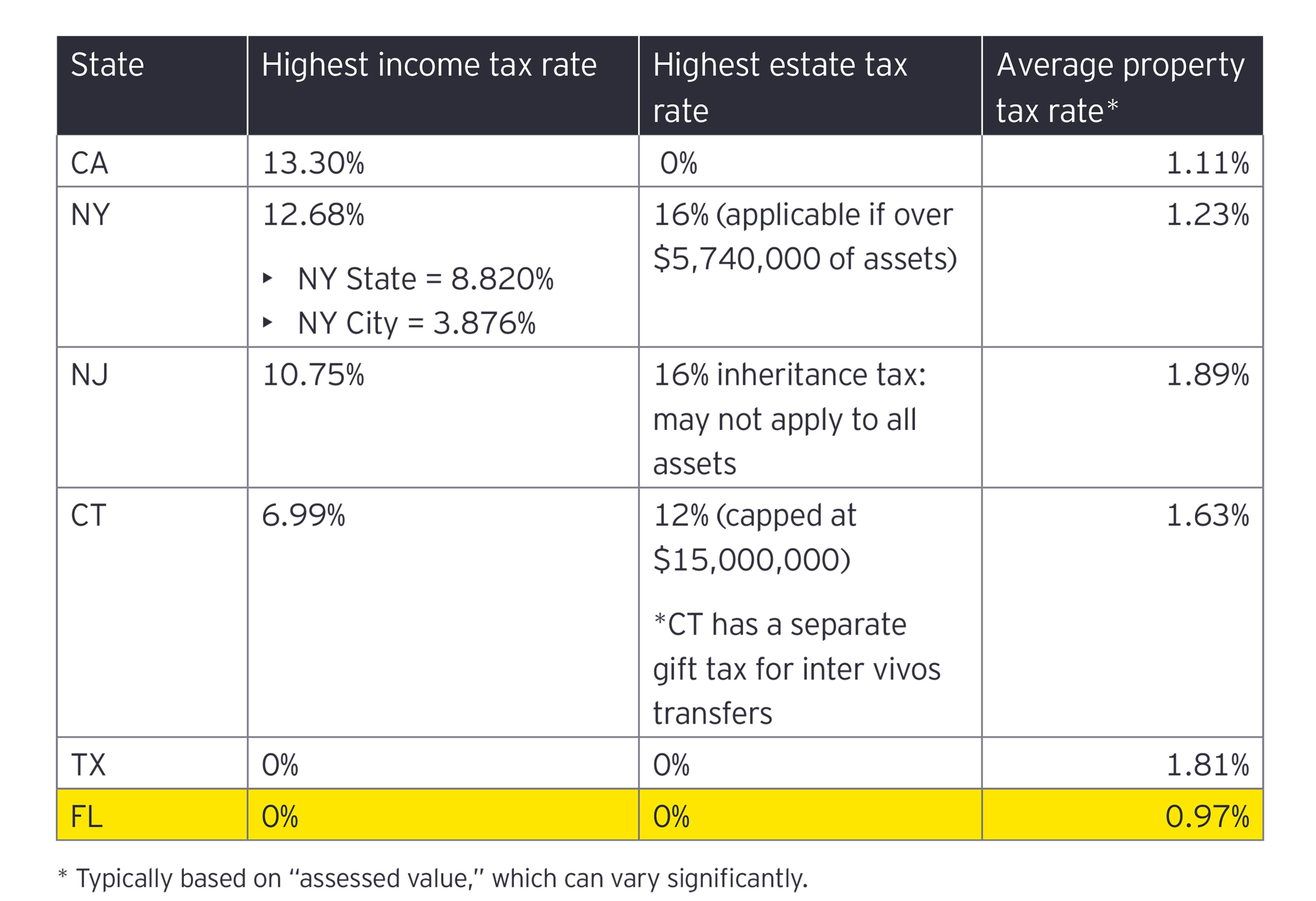

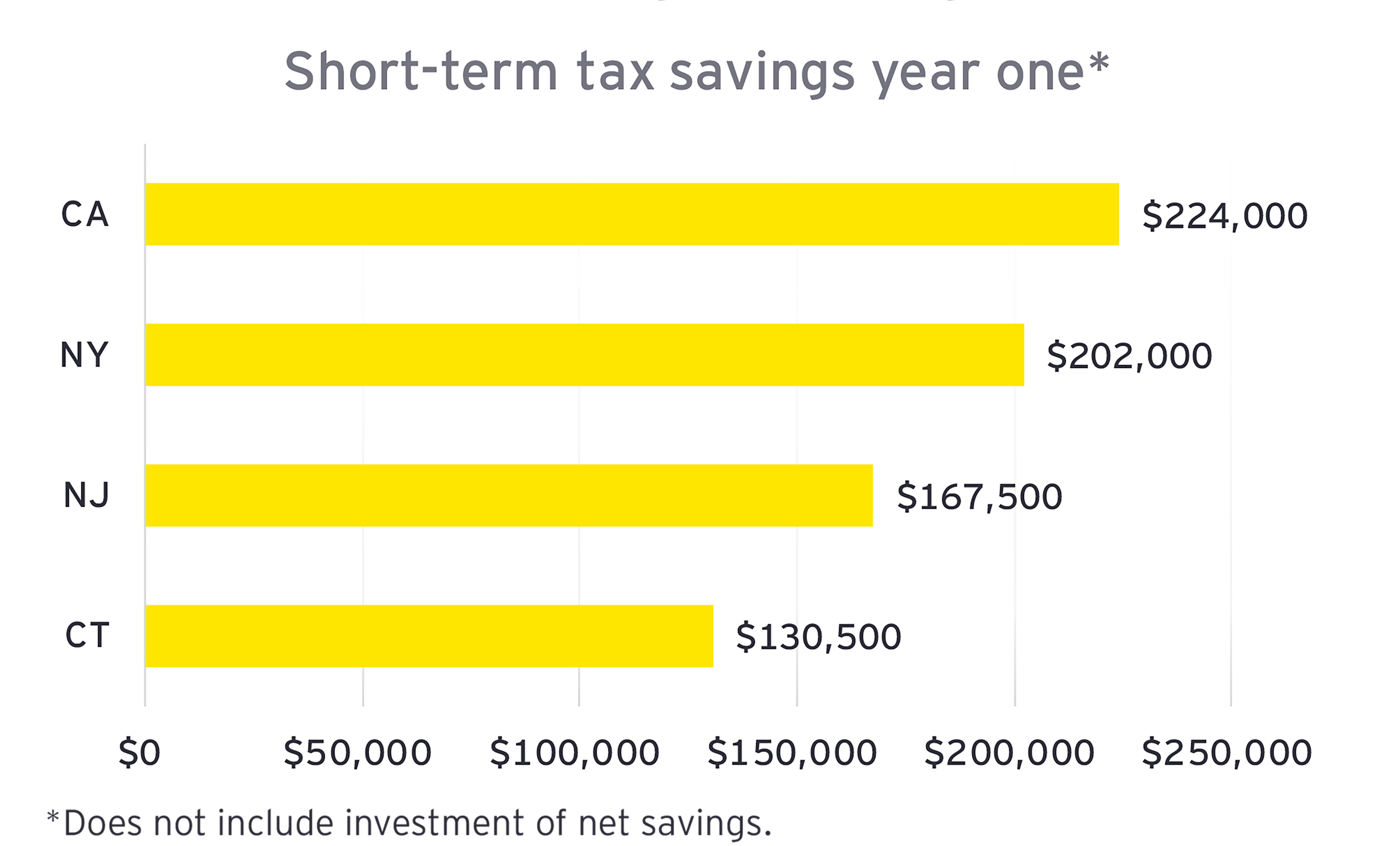

Tax Considerations When Moving To Florida Ey Us

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tax Considerations When Moving To Florida Ey Us

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

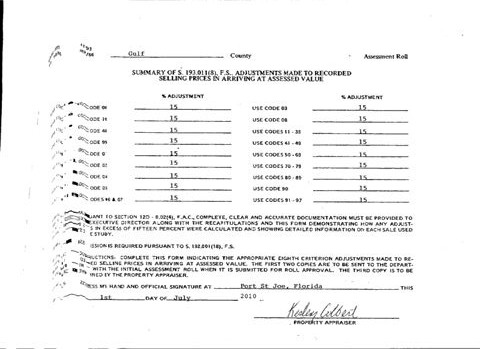

Florida Dept Of Revenue Property Tax Data Portal

How To Lower My Property Taxes In Florida Learn More

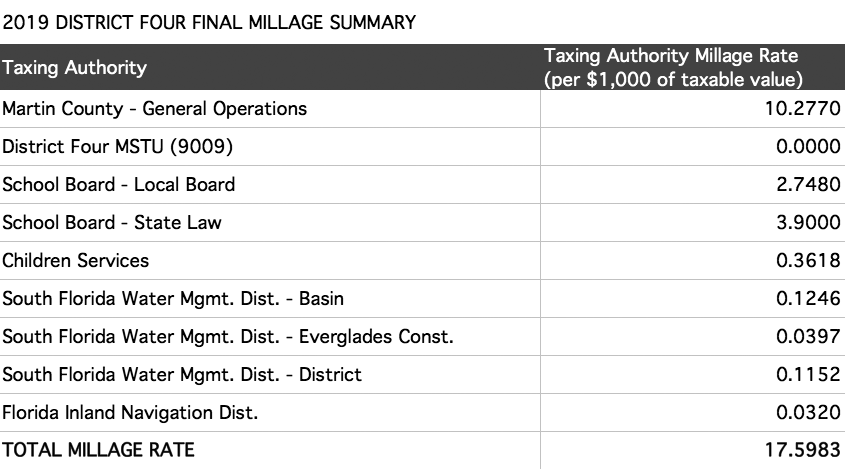

Are The Taxes Lower In Martin County Than Palm Beach County 2019 R R Realty Jupiter Real Estate

How Can I Minimize My Property Taxes In Florida Florida Homestead Check

Property Tax Calculator Smartasset

Florida Property Taxes Explained

Tax Comparison Florida Verses Georgia

Historical Florida Tax Policy Information Ballotpedia